Table of Contents

- Consumer Price Index For All Urban Consumers 2024 - Marje Shandra

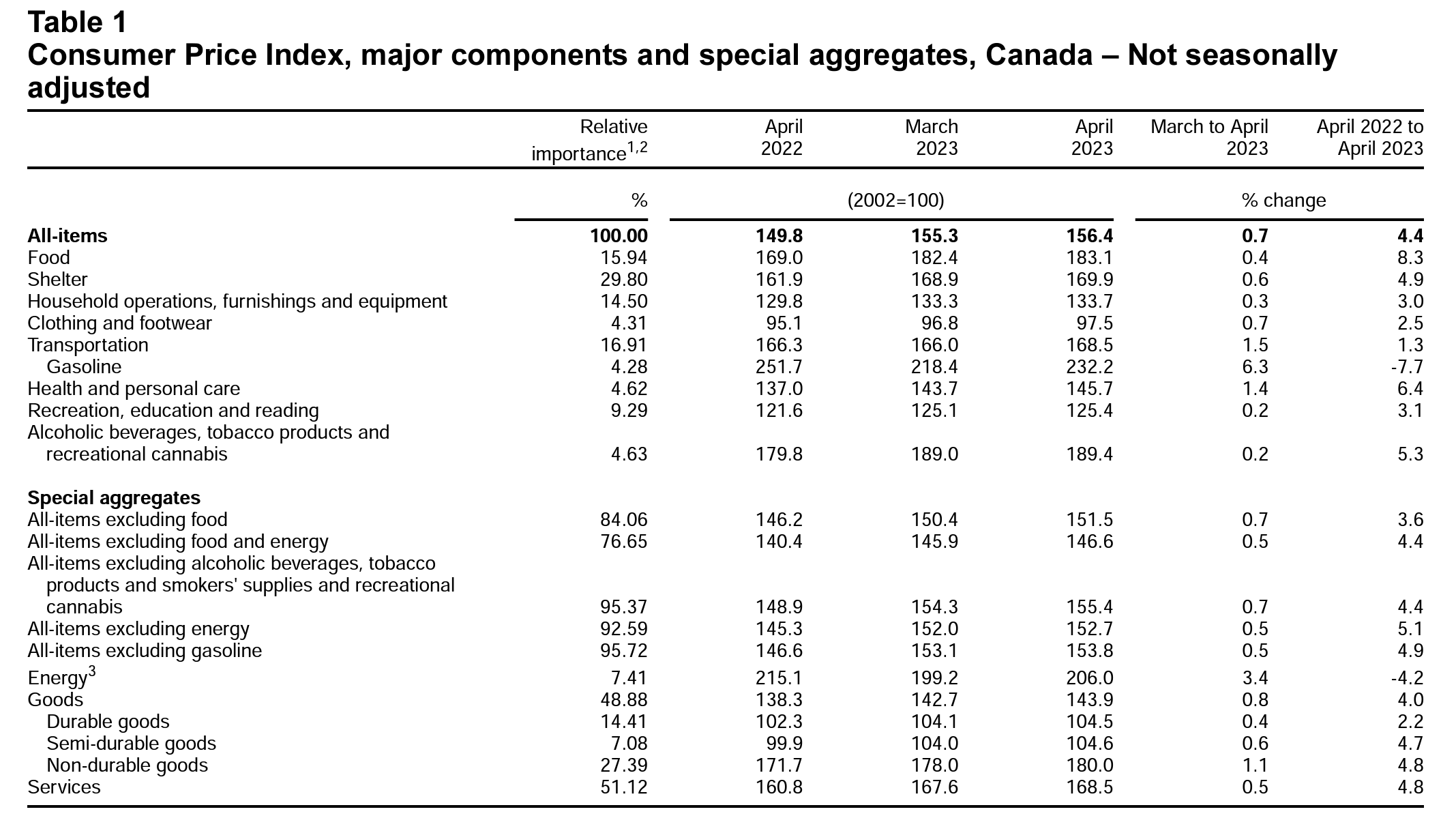

- The Consumer Price Index Rose by 0.7% Monthly and 4.4% Y-O-Y in April ...

- Perkembangan Indeks Harga Konsumen/Inflasi Januari 2024 Kabupaten ...

- August 2023: Sectoral Check Up (Consumer Cyclical) - Ajaib

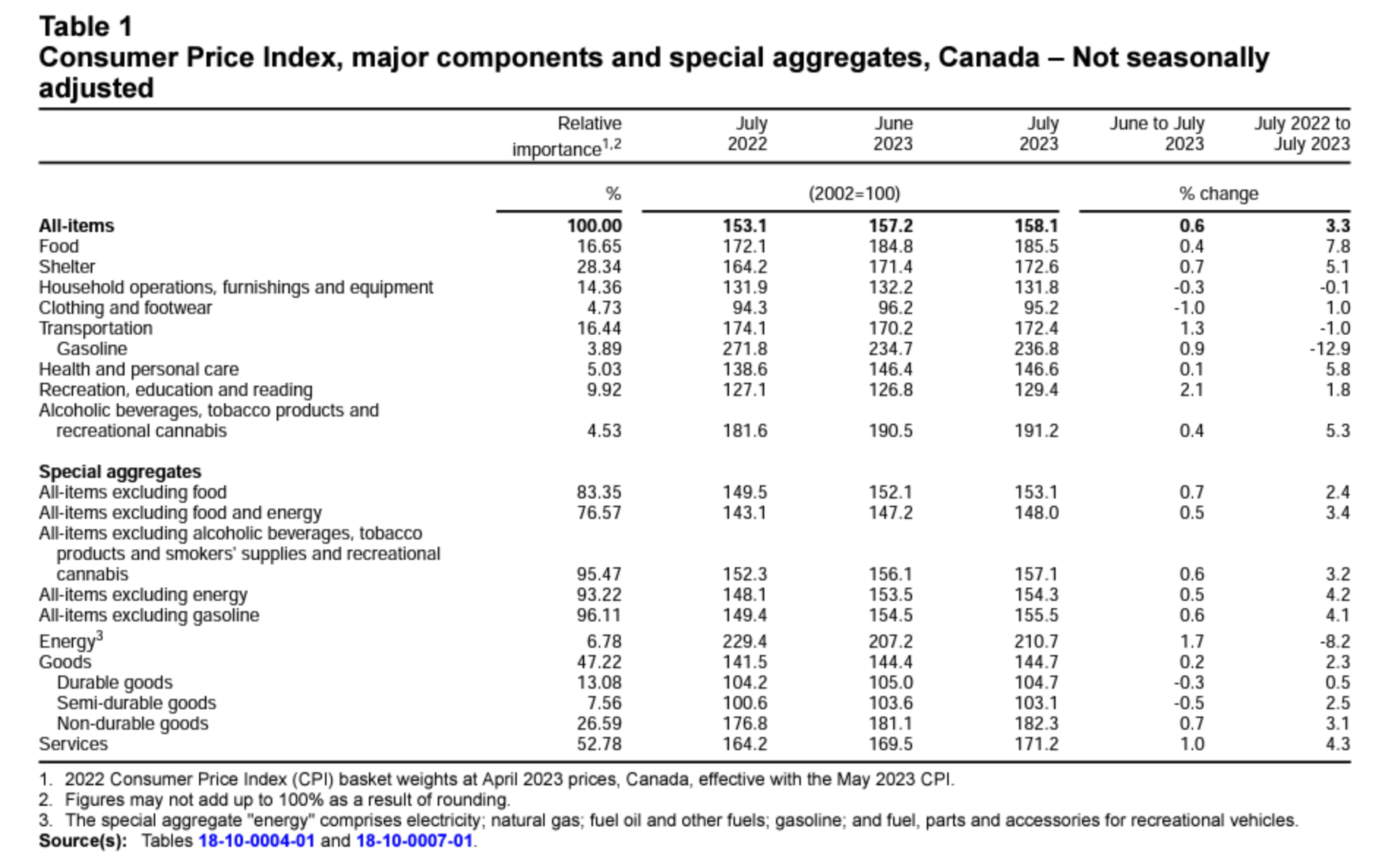

- The Consumer Price Index Rose by 0.6% Monthly and 3.3% Y-O-Y in July ...

- Spark Magazine - Kleinman Center for Energy Policy

- Consumer Price Index (CPI) of Indonesia; Low Inflation Continues in ...

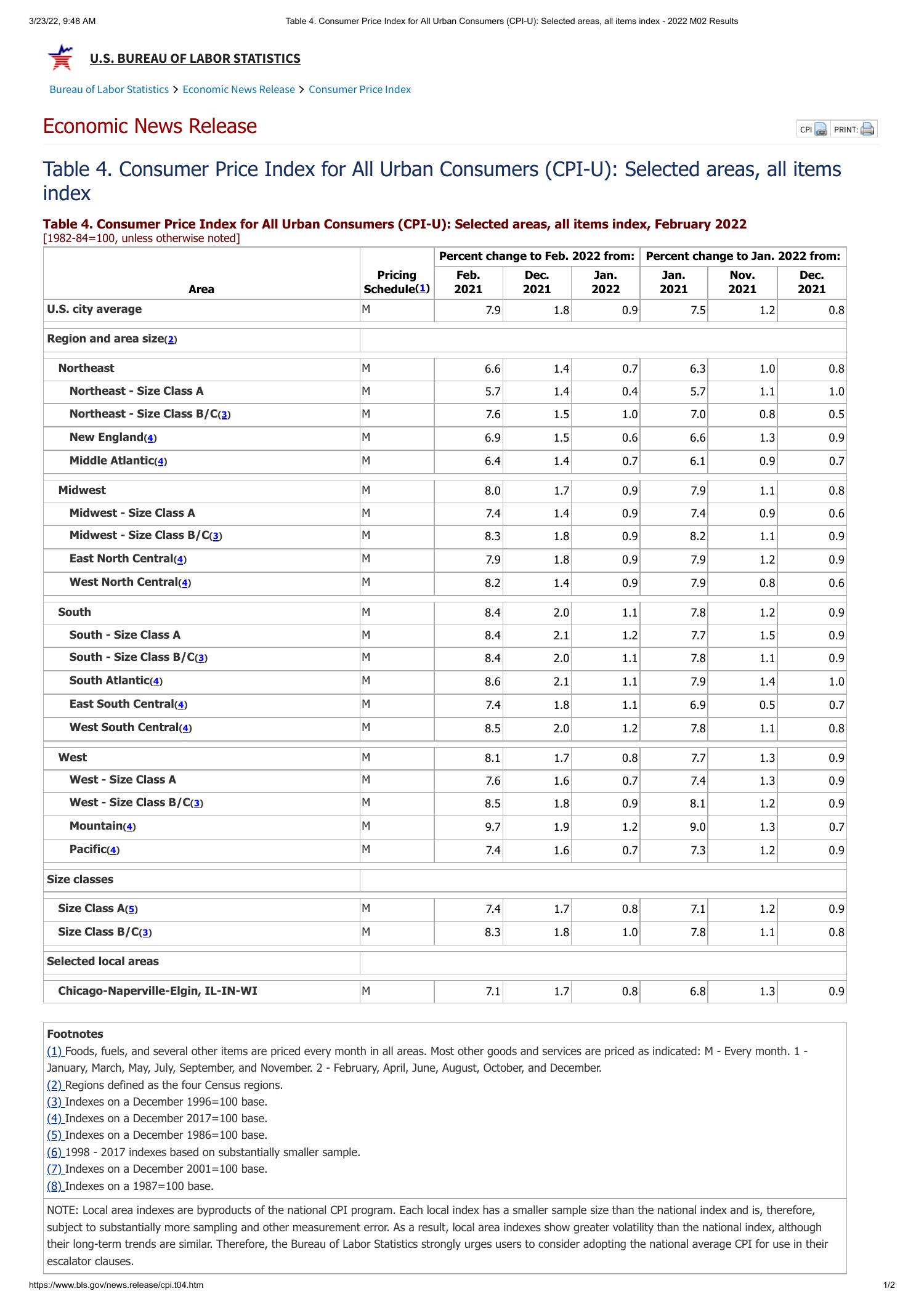

- The Consumer Price Index Rose 0.4% in February, Seasonally Adjusted ...

- Consumer Price Index

- Fillable Online indeks harga pengguna consumer price index - Academia ...

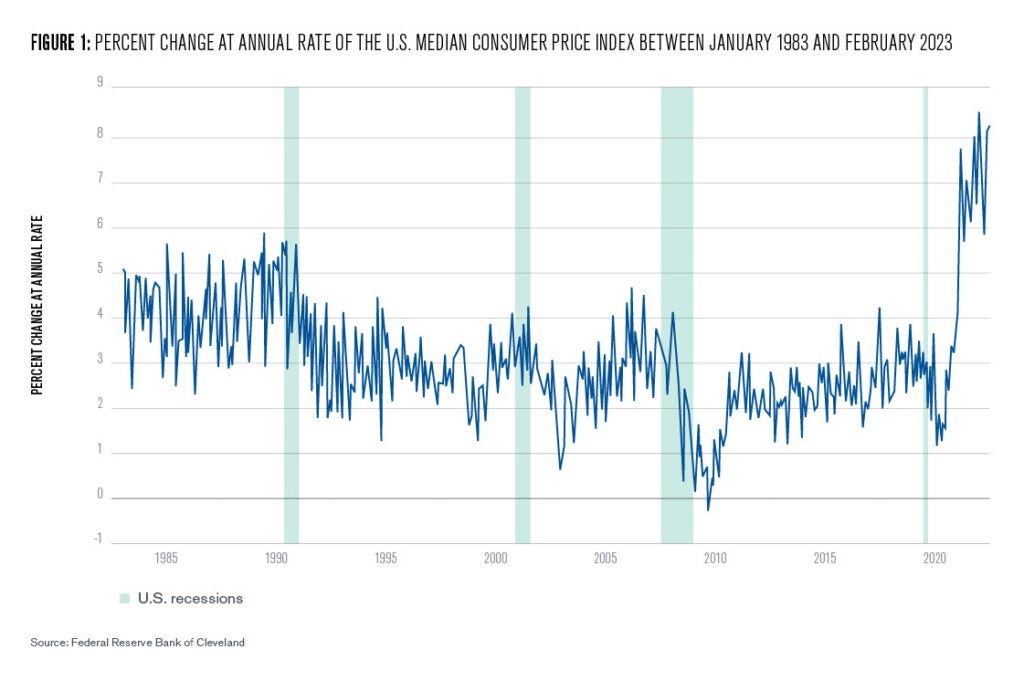

Understanding the US Consumer Price Index

US Consumer Price Index Forecast: Current Trends and Outlook

Factors Influencing the US Consumer Price Index Forecast

Several factors can influence the US CPI forecast, including: Labor market conditions: A strong labor market with low unemployment and rising wages can lead to higher inflation. Global economic trends: Changes in global demand, trade policies, and commodity prices can impact inflation. Monetary policy: The Federal Reserve's decisions on interest rates and quantitative easing can influence inflation expectations. Supply chain disruptions: Disruptions to supply chains, such as natural disasters or trade wars, can lead to price increases.

Implications of the US Consumer Price Index Forecast

The US CPI forecast has significant implications for investors, consumers, and policymakers. A moderate increase in inflation can lead to: Higher interest rates: To combat rising inflation, the Federal Reserve may increase interest rates, which can impact borrowing costs and consumer spending. Increased consumer prices: Higher inflation can lead to increased prices for goods and services, reducing the purchasing power of consumers. Investment opportunities: A moderate increase in inflation can create investment opportunities in sectors such as commodities, real estate, and Treasury Inflation-Protected Securities (TIPS). The US Consumer Price Index forecast, as tracked by YCharts (I:USCPINQ), provides valuable insights into the future direction of inflation and economic growth. Understanding the factors that influence the CPI forecast can help investors, consumers, and policymakers make informed decisions. As the US economy continues to grow, it is essential to monitor the CPI forecast and its implications for the economy, inflation, and monetary policy.By following the US Consumer Price Index forecast, you can stay ahead of the curve and make informed decisions about your investments and financial planning. Stay tuned for updates and analysis on the US CPI forecast and its implications for the economy.