Table of Contents

- The 20 year Treasury Bond versus the TLT ETF - Which is better for ...

- ISHARES 20 YEAR TREASURY BOND ETF (TLT.O) | Tech Charts

- Charts on Yield & TLT - MPTrader

- Ishares 20 Year Treasury Bond Etf Stock (TLT) Option Chain - StockScan

- TLT Stock Price and Chart — TradingView

- TLT: A Look At The Fundamentals (NASDAQ:TLT) | Seeking Alpha

- Ishares 20+ Year Treasury Bond ETF Trade Ideas — NASDAQ:TLT — TradingView

- TLT Stock Fund Price and Chart — NASDAQ:TLT — TradingView

- Reflecting on My Cybersecurity Internship at TLT - Tomorrow's Leaders Today

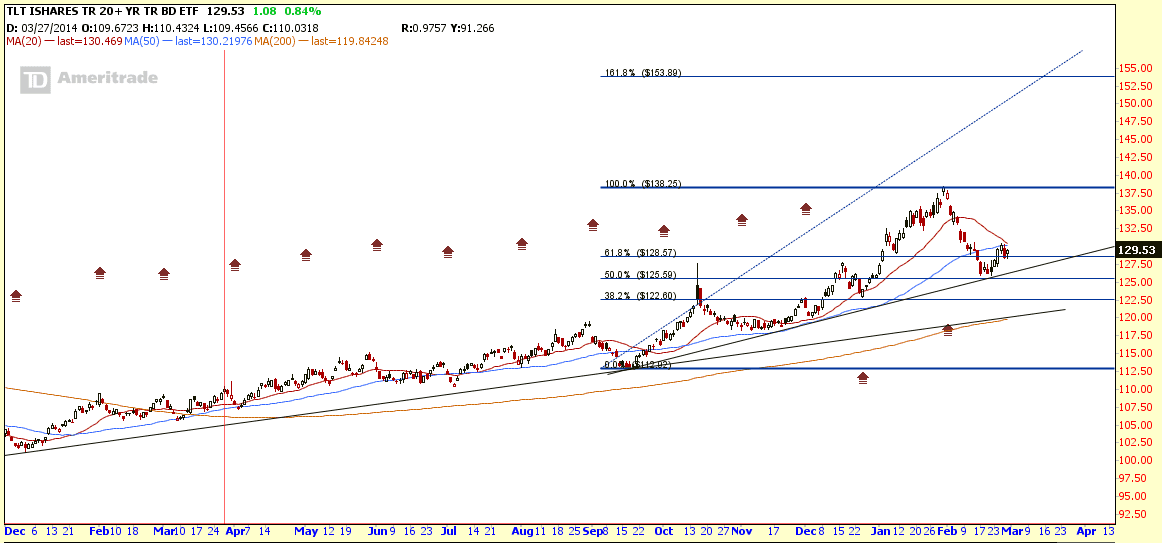

- iShares 20+ Year Treasury Bond (TLT): Continue Up Trend - My Stocks ...

What is iShares 20+ Year Treasury Bond ETF (TLT)?

TTL has a unique investment profile that sets it apart from other bond ETFs. Its focus on long-term government bonds makes it an attractive option for investors seeking stable returns and lower credit risk.

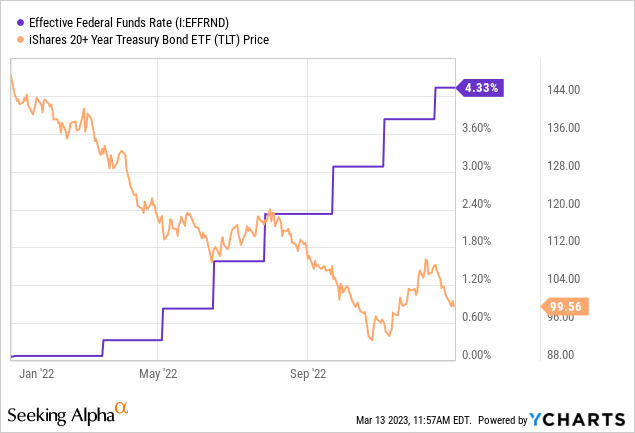

Price Performance

In recent years, TLT's price has been impacted by the Federal Reserve's monetary policy decisions. When interest rates rise, the value of existing bonds with lower yields decreases, causing their prices to fall. Conversely, when interest rates decline, bond prices tend to increase.

News and Developments

The iShares 20+ Year Treasury Bond ETF (TLT) is not immune to market fluctuations and economic events. Here are some recent news and developments that have impacted the fund's price performance:- Federal Reserve interest rate decisions: The Fed's actions have a direct impact on TLT's price, as changes in short-term interest rates affect the yields of long-term government bonds.

- Market volatility: Global economic uncertainty and market fluctuations can lead to increased demand for safe-haven assets like US Treasury bonds, driving up their prices.

- Budget deficits and debt ceiling debates: Changes in government spending and borrowing levels can impact the demand for US Treasury securities, influencing TLT's price performance.

As an investor considering iShares 20+ Year Treasury Bond ETF (TLT) for your portfolio, it's essential to stay informed about these developments and their potential impact on the fund's price.

The iShares 20+ Year Treasury Bond ETF (TLT) is a unique investment option that offers exposure to long-term government bonds in the United States. Its price performance is influenced by interest rates, economic growth, and inflation, making it an attractive option for investors seeking stable returns and lower credit risk. By staying informed about market trends and news, you can make informed decisions about your investment portfolio and achieve your financial goals.