Table of Contents

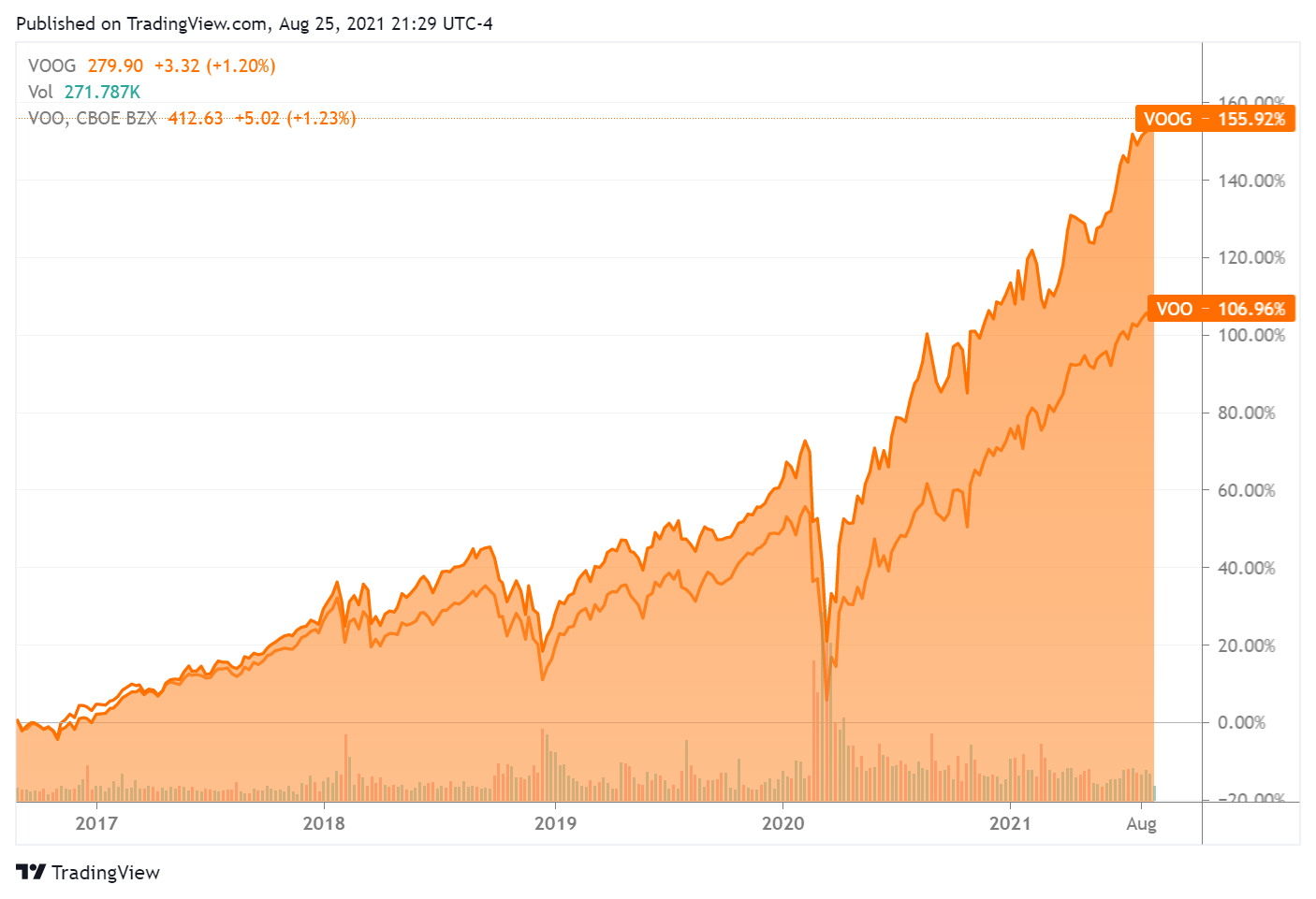

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- Here's Why You Should Buy Vanguard ETFs During the Market Meltdown ...

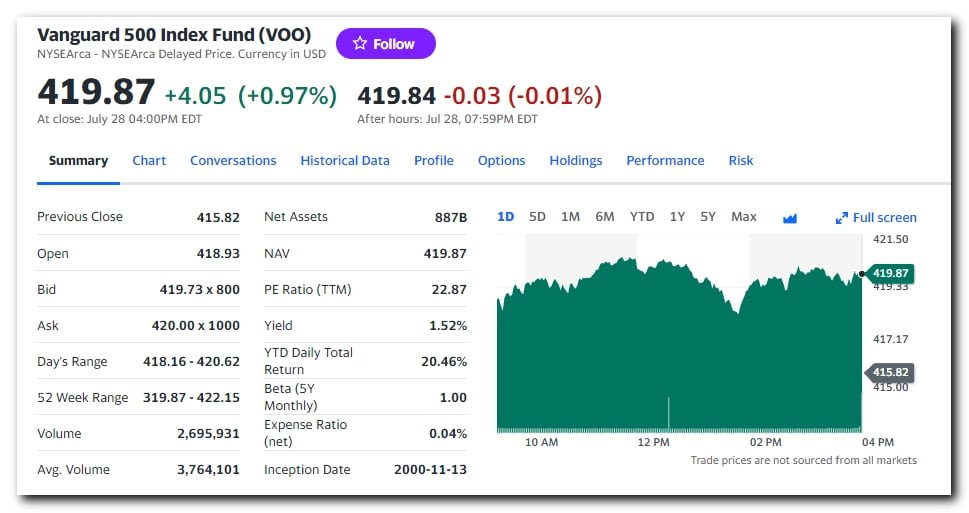

- Vanguard S&P 500 ETF (VOO.MX) Stock Price, News, Quote & History ...

- 미국 인기 ETF 주식 5개 종목 - 불주사

- VOO Stock Price and Chart — AMEX:VOO — TradingView

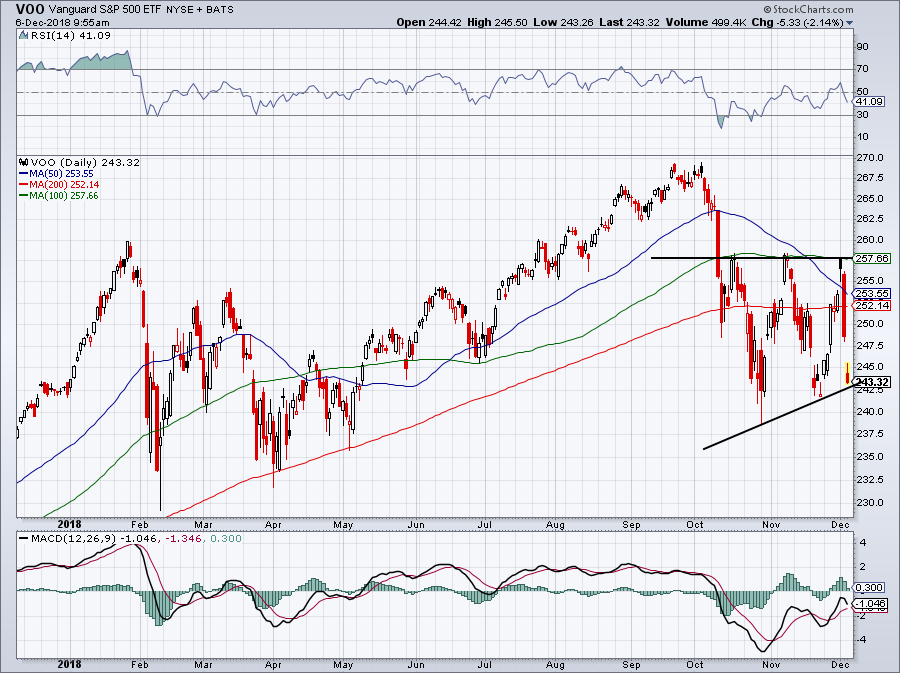

- Tradingview Supply And Demand Script Voo Stock Technical Analysis ...

- Tradingview Supply And Demand Script Voo Stock Technical Analysis ...

- VOO介紹:美股報酬最佳的ETF!慢慢變富的最好選擇,報酬以及風險分析 - 懶人經濟學

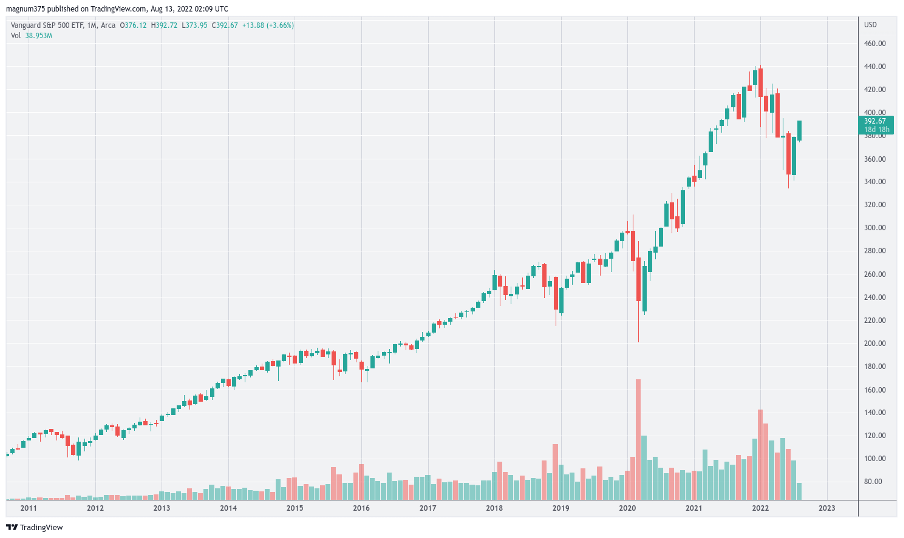

- Voo Etf Price History at Helen Robledo blog

- Vanguard S&P 500 VOO ETF - Stock Price and History | Sortter

What is the Vanguard S&P 500 ETF (VOO)?

Benefits of Investing in the Vanguard S&P 500 ETF (VOO)

Performance of the Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF (VOO) has a long history of strong performance, with the fund providing investors with average annual returns of over 10% since its inception. According to Yahoo Finance, the VOO ETF has a 1-year return of 13.44%, a 3-year return of 10.34%, and a 5-year return of 13.19%.